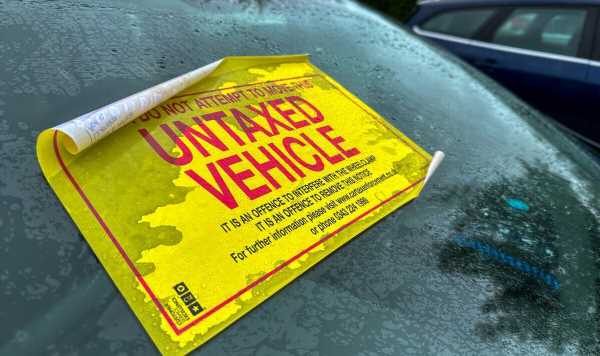

DVLA issues ‘simple’ car tax warning with motorists facing £2,500 fine

DVLA manager explains the importance of taxing your vehicle

DVLA chiefs have issued a fresh car tax warning to drivers with road users facing a £2,500 fine for failing to comply.

The DVLA has urged motorists to make sure their vehicle is fully taxed if it has been off the road for a period of time.

Motorists do not need to pay road tax if they have applied successfully for a Statutory Off-Road Notification (SORN).

This can be used if owners have no intention of ever using their vehicle and it is stored off the road in an area like a private garage.

SORN’s last indefinitely meaning owners do not need to stay in regular contact with officials.

READ MORE DVLA releases driving licence medical data with elderly drivers most impacted

However, motorists must make sure they update their details before getting back behind the wheel or could risk a charge.

The DVLA posted on X, formerly Twitter: “Need to drive your car again after telling DVLA it’s off the road? Simply tax it online to get back on the road again.”

The post was followed by a link directly to the GOV.UK vehicle tax website where drivers can make instant changes.

GOV.UK states: “Your SORN is automatically cancelled when you tax your vehicle again or if you sell, permanently export or scrap your vehicle. You do not need to renew a SORN.

“Your vehicle must stay in the UK for your SORN to be valid.”

DON’T MISS

DVLA asks if ‘changes are needed’ to driving licences with elderly affected[LATEST]

DVLA looks into whether elderly drivers should pay for driving licence checks[ANALYSIS]

Drivers could be issued £300 fine as new DVLA number plates launch[COMMENT]

We use your sign-up to provide content in ways you’ve consented to and to improve our understanding of you. This may include adverts from us and 3rd parties based on our understanding. You can unsubscribe at any time. More info

Experts at Carwow have warned motorists could be issued a whooping £2,500 if they fail to tax a vehicle which has been issued a SORN.

However, motorists can still use the vehicle for one particular use due to a special allowance in the rules.

They explained: “If your car is SORN, it must be kept off the road and therefore you cannot drive it. This is because all cars used on the public road must be taxed and insured. Do so and you risk a fine of up to £2,500, and possibly a court appearance.

“The only exception is if you are driving the car to or from a pre-booked MOT appointment.”

DVLA chiefs have also issued a reminder to drivers to set up regular tax reminders so they never forget a payment.

Drivers who do not pay their road tax will be issued an automatic penalty from the DVLA database.

This will be charged at £80 but the payable fee can be cut to £40 if paid within 33 days.

The DVLA wrote on social media: “Set up your Driver and vehicles account on GOV.UK and you can choose to receive vehicle tax reminders by text or email. Do it today – it only takes 5 minutes.”

Source: Read Full Article